1040 2024 Schedule A Form 1040 – The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . If you’re new to gambling, you may be surprised to learn that no matter the size of the winnings, whether cash or noncash, they must be reported to the IRS. .

1040 2024 Schedule A Form 1040

Source : www.investopedia.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.org1040 (2023) | Internal Revenue Service

Source : www.irs.govWhat Is Schedule A of Form 1040?

Source : www.thebalancemoney.com1040 (2023) | Internal Revenue Service

Source : www.irs.govHarbor Financial Announces IRS Tax Form 1040 Schedule C

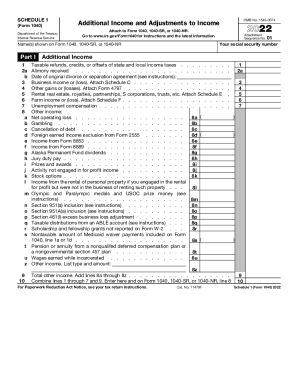

Source : www.kxan.comIRS 1040 Schedule 1 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov1040 2024 Schedule A Form 1040 All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: If your finances have been hit hard in recent months, the last thing you want to do is shell out more cash to file your taxes — which is already a dreaded experience for many. Fortunately, you may . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-e2490b265c7e42d1b79c9d70835003fd.png)

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)